Rare earth stocks rally on signs Trump supports sector

US critical minerals stocks have soared this week, getting a boost from signs that the Trump administration will favor a sector that’s become a flashpoint in the trade standoff between the US and China.

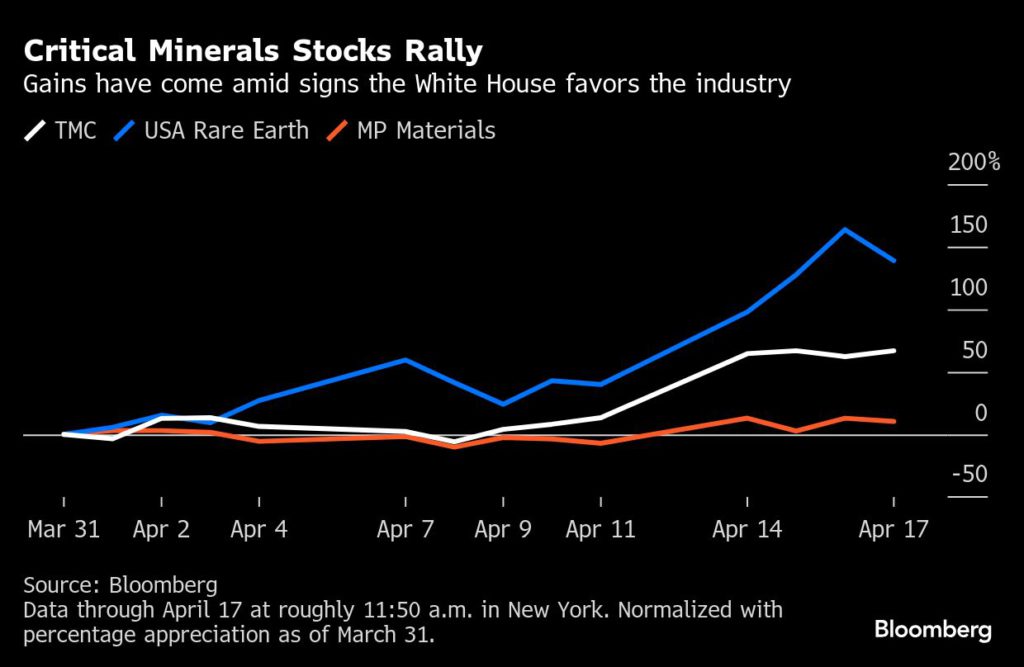

Rare-earth magnet player USA Rare Earth (NASDAQ: USAR) has jumped 71% this week as of 11:02 a.m. on Thursday, while TMC The Metals Company Inc., a Vancouver-based company that’s seeking permission from the US to gather metals at the bottom of the ocean, is up 52%.

Shares of MP Materials Corp., a miner and refiner of rare earth elements, have gained 17% and are set for their best performance since September in the short trading week.

All three soared on Monday after the Financial Times reported over the weekend that the Trump administration is planning an executive order to enable the stockpiling of critical metals found on the floor of the Pacific Ocean.

The US was responding to China’s efforts to limit exports of its own rare earth supplies. MP Materials and USA Rare Earth jumped again on Wednesday after Trump launched a probe into the need for tariffs on critical minerals.

“It seems the moves that they’re making would suggest that they understand that we have to build out our supply chain here,” Steven Schoffstall, director of ETF product management at Sprott Asset Management, said of the Trump administration.

“If you want to tariff something, presumably you want to build up that industry within the US borders, and the hope there is that investment will follow.”

The actions have become a central part of the escalating trade tension between Washington and Beijing. China is the dominant producer of metals that are vital to making crucial products like computer chips, nuclear reactor rods and fighter planes, and Beijing appears to be using that position to push back against Trump’s tariffs. As Washington looks to boost domestic production, Trump’s trade probe could cover all minerals defined as critical by the United States Geological Survey, a list that includes rare earth elements alongside other materials like lithium, cobalt and zinc.

MP Materials bills itself as the sole fully-integrated producer of rare earths in the US, with capabilities ranging from mining and refining to magnet manufacturing.

USA Rare Earth is building a magnet factory in Oklahoma that’s scheduled to come online commercially next year, and it owns a rare earth deposit in Texas where it plans to extract ore for its own facility and other sectors such as the defense industry.

TMC aims to gather nodules that contain metals such as cobalt and nickel used in electric vehicle batteries. Its move to seek approval from the Trump administration has drawn condemnation from an organization affiliated with the United Nations that regulates the commercialization of deep sea resources.

Trump’s moves have made the three stocks winners even as his trade war has punished broader markets. TMC and MP Materials are up double digits since Feb. 19, a period that’s seen the S&P 500 Index fall 14%. Rare Earth USA shares have been volatile since the firm went public last month by merging with a special-purpose acquisition company, but they’ve more than doubled this month.

Uranium miners including Energy Fuels Inc. and Uranium Energy Corp. notched their own advances on Wednesday after Trump signed an order calling for the trade probe. Energy Fuels jumped again Thursday after saying it had developed technology to produce most of the rare earth compounds subject to new Chinese export curbs.

Despite the indications that mining companies will be favored by the administration, tariffs could present complications by raising costs for parts of the supply chain that remain outside the US. For rare earths, opening new mines in the US could take years, while new processing facilities may have a hard time competing with long-running international ones, Benchmark analyst Subash Chandra said.

“Once you sort of unthread it all, there is no clear line of sight of a non-Chinese feedstock through a non-Chinese processing facility to the end user,” Chandra said. “If we say we’re going to penalize everything that’s not American, yes there’s a benefit to these companies, but there’s also cost to these companies.”

(By Matthew Griffin)

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments